This offers an appealing financial break for retirees, investors, and military members, as it can mean they keep more of their earnings. Capital gains from investments and dividends are not taxed at the state or local level, another by-product of Florida not having a personal income tax. U.S. Secretary of State Marco Rubio wanted to swap property taxes on homes for an increase in the sales tax when he was speaker of the Florida House of Representatives in the late 2000s. LaMarca was skeptical of the idea that the obligation to pay property taxes means someone doesn’t own their own home, suggesting that theory could apply to all home-related expenses, including insurance and more. The Florida Policy Institute will soon release a report highlighting that households earning low to moderate income, including renters, “would bear a disproportionate burden if sales taxes were increased to offset lost revenue,” Santis said.

Is DeSantis talk of eliminating property taxes…

Taxpayers who received more than $5,000 in payments for goods and services through an online marketplace or payment app in 2024 should expect to receive a Form 1099-K PDF in January 2025. The last day to file taxes is called Tax Day, and it always falls on April 15, unless it’s a weekend or holiday. Those in Florida affected by Hurricane Helene and Hurricane Milton in 2024 may have an extra couple of weeks to file, according to the IRS. Here’s when the last day to file taxes is, what documents you’ll need, a quick breakdown on some new forms for the 2024 and 2025 tax season and how to track your tax refund.

Logistics Calculators

- Florida Governor Ron DeSantis has signaled his support for eliminating property taxes in the Sunshine State or drastically lowering them, though such a move is expected to be an uphill battle.

- Though DeSantis said details of a plan to eliminate property taxes need to be worked out, he has ruled out one thing.

- So the total shortfall from eliminating property taxes would be less than the combined total of $55.2 billion, Khan said.

- Select a periodic pay calculator below, continue reading to view the detailed instructions for this set of calculators or access alternate tax calculators in the Florida Tax Hub.

- The average combined state and local sales tax rate is 6.11 percent.

Florida property rates are relatively low compared to the national average and a Florida tax relief bill passed last year allows Floridians to enjoy many items tax-free. Though DeSantis said details of a plan to eliminate property taxes need to be worked out, he has ruled out one thing. He has said he’d never sign an increase in state sales taxes into law to cover the cost of services currently paid for by the property tax. At the moment, Florida “supplements the absence of a state income tax with other sources of revenue, such as sales taxes,” Harpaz said.

State Individual Income Tax Rates and Brackets, 2018

This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or Insurance Accounting advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

The base sales tax rate is 6%, with some counties adding their own surtaxes, which range from 0.5% to 1.5%. Although rates vary, Florida’s property taxes tend to be in the middle range compared to other states, with an average 0.71% effective rate. Urban areas with higher housing prices, like Miami-Dade County, tend to levy higher property taxes. Because Florida does not have a personal income tax, military pensions and active-duty pay are not taxed. Local governments in Florida also depend on property taxes for revenue.

- For those with substantial retirement savings or pension benefits, these tax savings can amount to thousands of dollars annually compared to states that tax retirement income.

- Localities can add as much as 2%, and the average combined rate is 7.002%, according to the Tax Foundation.

- Find the full list on the homestead exemption application form.

- “The proposal—if implemented—may significantly reduce funding for government services and those who rely on them.”

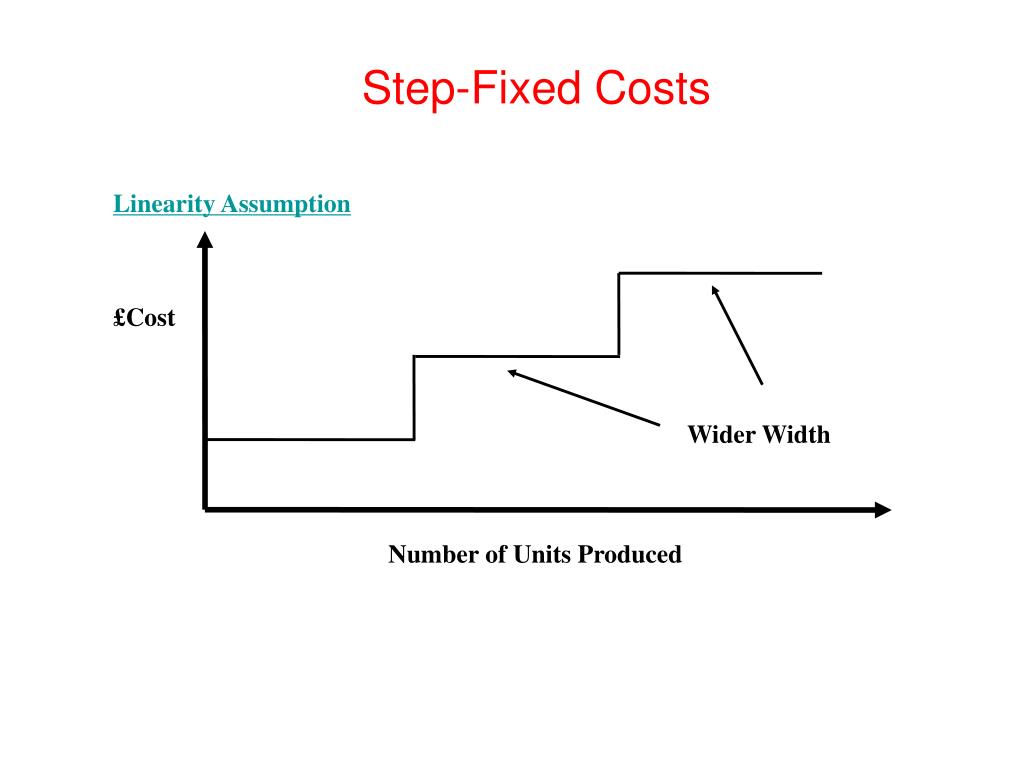

- Some states double their single-filer bracket widths for married filers to avoid imposing a “marriage penaltyA marriage penalty is when a household’s overall tax bill increases due to a couple marrying and filing taxes jointly.

Other types of common taxes in Florida

Additionally, Florida has developed an extensive network of assisted living facilities, skilled nursing homes, and memory care centers to accommodate varying levels of care. While these costs don’t typically outweigh the benefits of zero state income tax, they should be retained earnings balance sheet carefully factored into retirement planning—especially for those on fixed incomes. Allowances provided to reduce taxable income are commonly known as “tax deductions” in the context of the United States tax system. Tax deductions lower your taxable income, and consequently, your tax liability. They are subtracted from your gross income, making the income subject to tax lower.

- Washington also has one of the highest sales tax rates, with an average combined state and local rate of 9.38 percent.

- “Basically the Save Our Homes amendment has worked as advertised.

- This lowers your taxable income, which means you will owe less in taxes.

- 8, enacted in September 2023, the top individual income tax rate in Arkansas was reduced from 4.7 percent to 4.4 percent for tax years beginning on or after January 1, 2024.