The point at which a step cost will be incurred can be delayed by implementing production efficiencies, which increase the number of units that can be produced with the existing production configuration. Another option is to offer overtime to employees, so that the company can produce more units without hiring additional full-time staff. True valuable costs are those variable costs that have a direct and one to one relationship with output levels of a business. In other words, these costs are directly proportionate to output and change with every change in output level.

Fixed versus Variable Costs

- If the shop receives anywhere from zero to 30 customers per hour, it will only need to pay the cost of having one employee, say $50 ($20 for the employee, $30 for all other expenses, fixed and operating).

- For example, a local high-tech company did notlay off employees during a recent decrease in business volumebecause the management did not want to hire and train new peoplewhen business picked up again.

- Since the amount of direct materials required will change based on the number of units produced, direct materials are almost always classified as a variable cost.

- If demand rises to 1,050 units, the company might create an additional production shift to manufacture more units.

Cost accounting helps ensure that financial costs are within an acceptable range and helps an organization make reliable forward-looking financial decisions. These cost classifications are common in businesses that produce large quantities of an item that is then packaged into smaller, sellable quantities such as soft drinks or cereal. This method of costing is termed process costing and is covered in Process Costing. Where Y is the total mixed cost, a is the fixed cost, b is the variable cost per unit, and x is the level of activity. In other words, you will stay in business if you don’t incur the cost. If the pencil maker spends $5,000 on advertising the pencils, this is a fixed cost.

Effects of Changes in Activity Level on Unit Costs and Total Costs

Bert’s annual insurance premium is $10,800, which is $900 per month. Each month, Bert will recognize 1/12 of this insurance cost as an expense in the period in which it is incurred (Figure 2.24). The distributor charges $10 per bike for shipping for 1 to 10 bikes but $8 per bike for 11 to 20 bikes. If Bert wants to save money and control his cost of goods sold, he can order an 11th bike and drop his shipping cost by $2 per bike. It is important for Bert to know what is fixed and what is variable so that he can control his costs as much as possible. To illustrate a stepped cost, let’s assume that you are developing a website and find that the monthly cost of hosting the site is based on the number of visits.

Step Cost

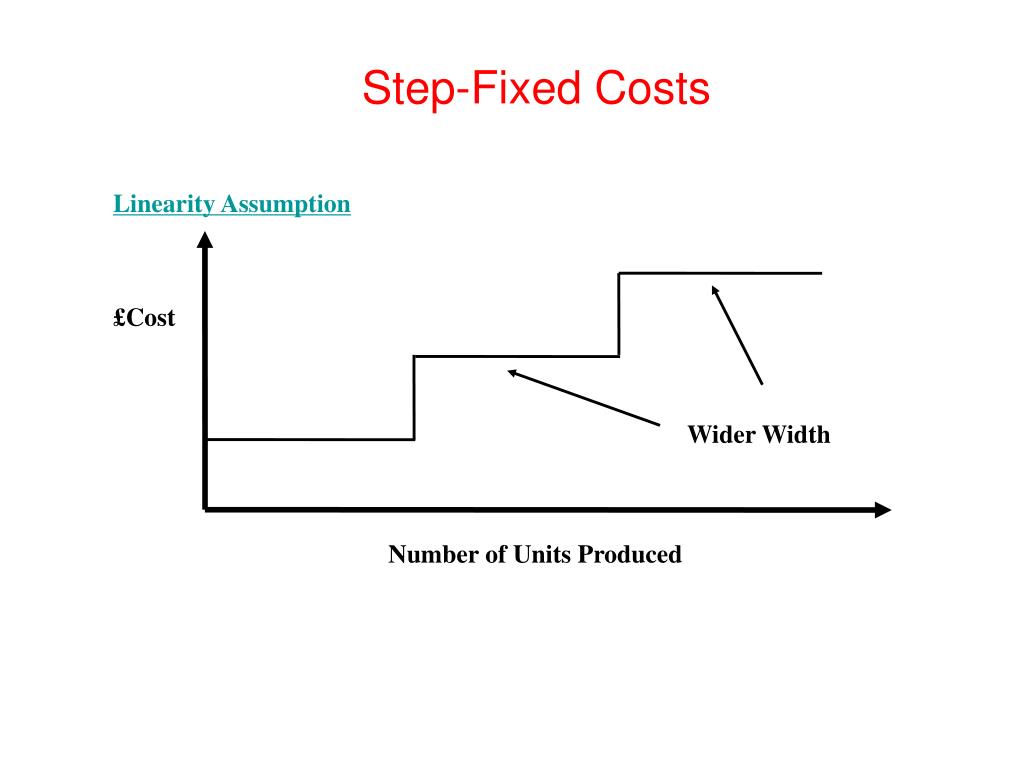

So, if for every single unit increase in output, a particular cost element also increases by a specific quantum then this cost would qualify as a true variable cost. An example of step costs is a company that produces a certain product, deploying the machinery, production staff and workplace to produce a certain number of it per year (e.g., 20,000). If an order arrives requesting it to produce 30,000 per year for a period of three years. The company will start to incur step costs to account for the new production level. To that end, it requires to deploy additional machinery, personnel and plant as an additional cost per year. Step cost behaviors have significant implications for financial planning, budgeting, and decision-making.

Understanding Step Costs

Other examples of step costs for companies include salaries and benefits, which remain a constant cost until a single sharp increase. As per the applicable threshold, the step cost for 18,000 units is $20,000 since the activity level lies in the last threshold of 15,001-20,000 units. By identifying the thresholds at which step cost behavior occurs, businesses can anticipate changes in their cost structure and adjust their strategies accordingly. As you’ve learned, direct materials are the raw materials and component parts that are directly economically traceable to a unit of production. One way to deal with a curvilinear cost patternis to assume a linear relationship between costs and volume withinsome relevant range.

You’ve also learned that direct labor is the work of the employees who are directly involved in the production of goods or services. In fact, for many industries, the largest cost incurred in the production process is labor. For Carolina Yachts, their direct labor would include the wages paid to the carpenters, painters, electricians, and welders who build the boats.

It is not unheard of for a business to decide against taking steps to increase volume in order to maintain profitability at current levels. When they produce 625 boats, Carolina Yachts has an AFC of $2,496 per boat. What happens to the AFC if they increase or decrease the number of boats produced? Costs rarely behave in the simple way that wouldmake life easy for decision makers. Even within the relevant range,the assumed cost behavior is usually only approximately linear.

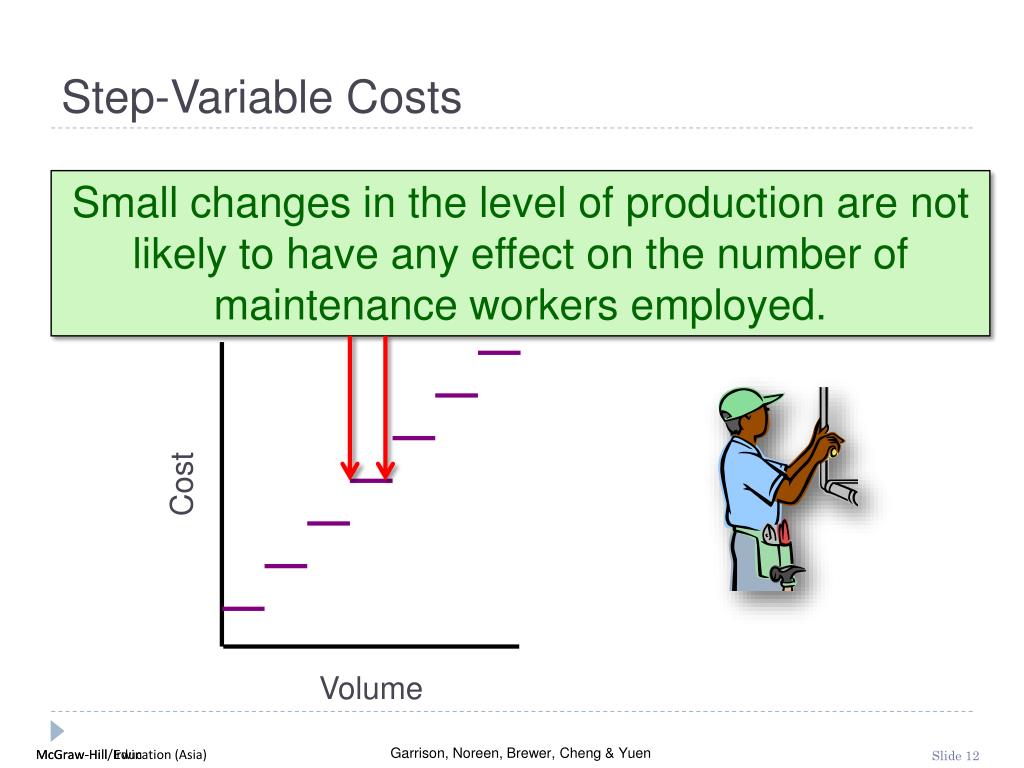

When you map out step costs on a graph, they reveal a stair-step pattern. These costs also provide valuable insights into cost-volume-profit relationships. Understanding how costs behave as activity levels change helps managers assess the financial feasibility of different production levels and product lines. The function of a step cost is to represent the sudden and discrete changes in expenses that occur at specific levels of activity or production. Step costs play a crucial role in cost analysis, financial planning, and decision-making for businesses and organizations. Step-variable CostsStep-variable costs are costs that are constant over a range of production.

Sometimes companies need to consider how those costs are reported in the financial statements. At other times, companies group costs based on functions within the business. For example, a business would group administrative and selling expenses by the period (monthly or quarterly) so that they can be reported on an Income Statement.

In some cases, the step cost may eliminate profits that management had been expecting with increased volume. The Ocean Breeze is located in a resort area where the county assesses an occupancy tax that has both a fixed and a variable component. Ocean Breeze pays $2,000 per month, best procurement software for small and midsize businesses regardless of the number of rooms rented. Even if it does not rent a single room during the month, Ocean Breeze still must remit this tax to the county. However, for every night that a room is rented, Ocean Breeze must remit an additional tax amount of $5.00 per room per night.